ABOUT US

Providing Mezzanine Financing to

Stable and Growing Lower Middle-Market Companies

IBC Funds provides flexible debt and equity capital solutions to lower middle-market companies. With a deep understanding of the challenges and opportunities facing small businesses, we partner with management teams, independent sponsors, and private equity groups to fuel growth, facilitate ownership transitions, and support strategic acquisitions.

IBC Funds provides flexible debt and equity capital solutions to lower middle-market companies. With a deep understanding of the challenges and opportunities facing small businesses, we partner with management teams, independent sponsors, and private equity groups to fuel growth, facilitate ownership transitions, and support strategic acquisitions.

Our Story

Founded in 2000, IBC Funds provides subordinated debt and non-control equity co-investments to lower middle-market companies throughout the United States. Our capital is typically used to support leveraged acquisitions backed by both independent sponsors and funded private equity sponsors in the lower middle-market. We also provide flexible junior capital to support management and family driven ownership transitions, add-on acquisitions, recapitalizations and growth initiatives.

Our investment strategy targets businesses with EBITDA of greater than $2 million which have sustainable long-term growth profiles. We invest across a variety of industries and target companies with high-quality management, adequate revenue diversification, stable and growing end-market demand, defensible market positions and sustainable free cash flow profiles. Our principals have over 150 years of experience working together at IBC Funds and prior firms. Together the IBC Team is responsible for more than $500 million of investee capital across more than 120 lower middle market portfolio companies.

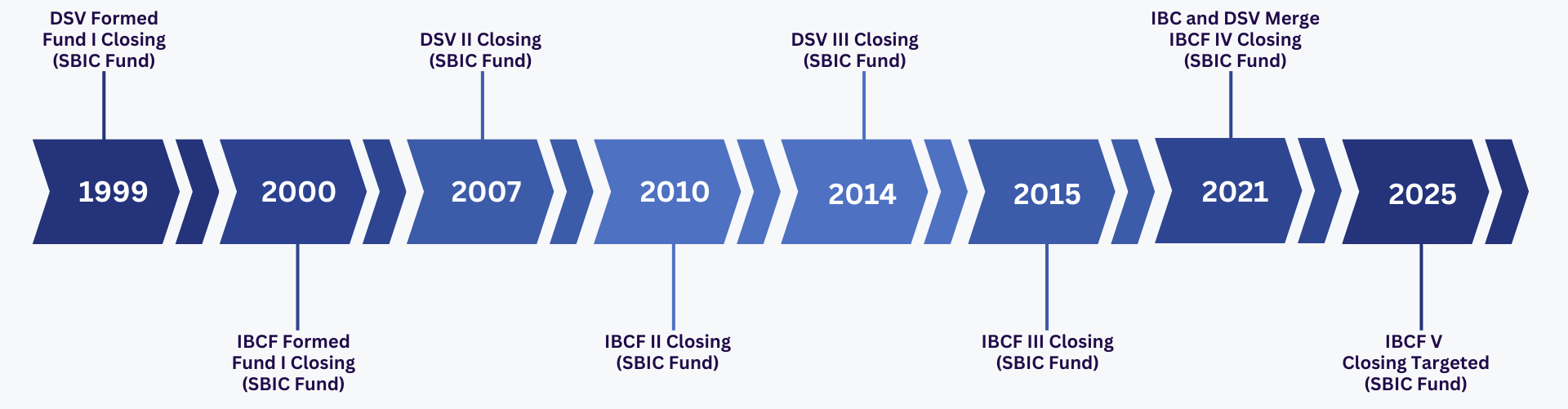

Our History

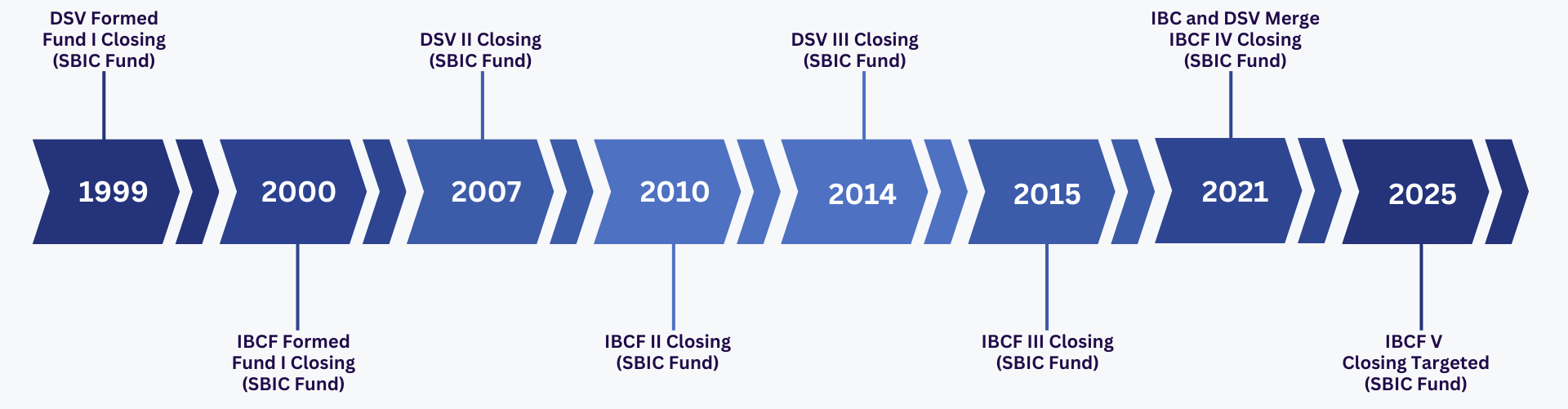

Independent Bankers Capital Fund, L.P. (”IBC Funds”) began operations in early 2000. At the time it was the first SBIC formed for exclusive investment by a large number of independent community banks and financial institutions. The limited partners included 56 such institutions located throughout the state of Texas. The Fund was formed with the idea that community banking is vital to the growth and success of cities, towns and rural areas across the country.

IBC Funds spawned two successor funds in 2010 and 2015, both of which co-invested in a number of portfolio companies alongside another SBIC firm, Diamond State Ventures (“DSV”). After forming a co-investor relationship spanning more than 20 years, the management teams of IBC Funds and DSV merged in June 2021 and began investing out of Independent Bankers Capital Fund IV, L.P.

Our Story

Founded in 2000, IBC Funds provides subordinated debt and non-control equity co-investments to lower middle-market companies throughout the United States. We finance leveraged acquisitions backed by lower middle-market private equity sponsors, independent sponsors, management and family driven ownership transitions, add-on acquisitions, recapitalizations and growth initiatives.

Our investment strategy targets businesses with EBITDA of $2 million and above with sustainable long-term growth profiles. We invest in a variety of industries in companies with high-quality management, adequate revenue diversification, stable and growing end-market demand, defensible market positions and sustainable free cash flow profiles.

Our principals have over 150 years of experience working together at IBC Funds and prior firms. They bring a combined track record of more than 120 mezzanine transactions totaling $500 million of invested capital.

Our History

Independent Bankers Capital Fund, L.P. (”IBC Funds”) began operations in early 2000. At the time it was the first SBIC formed for exclusive investment by a large number of independent community banks and financial institutions. The limited partners included fifty-six such institutions located throughout the state of Texas. The Fund was formed with the idea that community banking is vital to the growth and success of cities, towns and rural areas across the country.

IBC Funds spawned 2 successor funds, both of which co-invested with Diamond State Ventures (“DSV”) in a number of portfolio companies over a relationship spanning more than 20 years. In June of 2021, the management teams of IBC Funds and DSV merged and began investing out of Independent Bankers Capital Fund IV, L.P.